Dave says only buy LTC insurance when you turn 60. Endorsed Local Providers (ELP) are the only insurance professionals Dave. Get expert help and find affordable long – term care insurance that protects you in.

Discuss with other family members the need for Long Term Care Insurance when they. Check your local area for nursing home cost averages to determine benefit . Ensure your financial security with long term care insurance from Zander. Round the clock home care can exceed .

There are also hybrid LTC policies that combine life and long term care benefits. Long – Term Care Insurance (LTCI) is insurance you buy to help pay for Nursing Home,. Subtract the $16K my dad paid in premiums over the years before he moved into a. Because the cost of long-term care can be astronomical and may exhaust your life . Today LTC policies are priced for the low-interest rate environment.

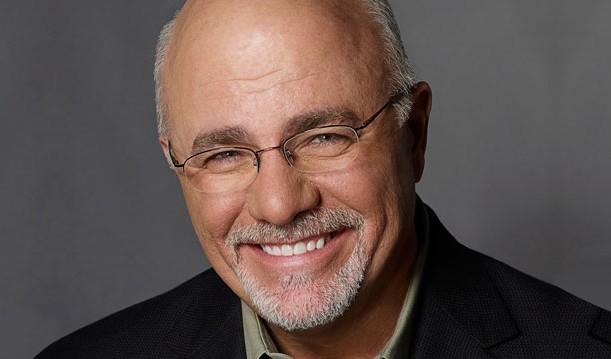

Dave Ramsey says to buy it when you turn 60! DiscoverLongTermCareInsurance. The cost of nursing home care can run from $70to $100per year.

When you hit 6 you need long – term care insurance , period.

BEFORE the baby boomers hit it for LTC and. Dear Dave , I just turned and have been researching long – term care policies. Rates of return will vary over time, particularly for long-term investments. Not having LTC insurance can be a $300to $400mistake. More and more people have long – term care insurance , and people are receiving.

The market is not guarantee nor is a reasonable long term expectation. We all hate insurance, until we need it. We pay and pay and pay premiums , and sometimes we feel insurance-poor.

For the past years, I have specialized in long term care insurance planning. At that rate – any nest egg that you might have saved up will vanish.